What You Need to Know About the Securities Financing Transaction Regulation in 2020

As we all know, the Securities Financing Transaction Regulation (SFTR) went into effect on April 11, 2019. However, less than 12 months after the official launch, there is news that ESMA already has some updates to the SFTR guidelines that will impact reporting hubs in a big way.

In this article, we will go into depth about what SFTR is, the challenges and solutions, and the changes we will likely see to SFTR during the first half of 2020.

What is SFTR?

SFTR was originally proposed by the European Commission in January 2014 in an effort to increase transparency in the European securities financing markets. The idea was that under the new regulation, all European-based firms would report their securities finance transactions (SFTs) to an assigned and approved trade repository. In addition to overseeing MiFID II/MiFIR, ESMA also oversees SFTR.

The Goals of SFTR

The overarching goal of the European Commission was to increase the level of transparency of securities transactions. For many years, investors and policymakers were concerned with the lack of information and reports justifying the source(s) of certain transactions and collateral agreements.

Then, during the financial crisis in 2007-2008, those concerns only increased. It was also discovered that collateral providers were potentially unaware of the potential risks of using collateral in multiple instances as part of a transaction chain.

Ideally, SFTR would eliminate these concerns and increase awareness surrounding the risks of entering into collateral agreements.

The Scope of SFTR

The rules and regulations set forth by SFTR will apply to the following:

- Any entity or counterparty involved in securities financing transactions.

- AIFMs and UCITS investment companies as it pertains to their obligation to publish their use of SFTs in their semi-annual and annual reports.

- Trade repositories.

- Any market participant or counterparty engaged in the re-use of collateral multiple times as part of transaction chains. This includes counterparties that are located in an EU member state but can also include counterparties located outside of the EU under certain conditions.

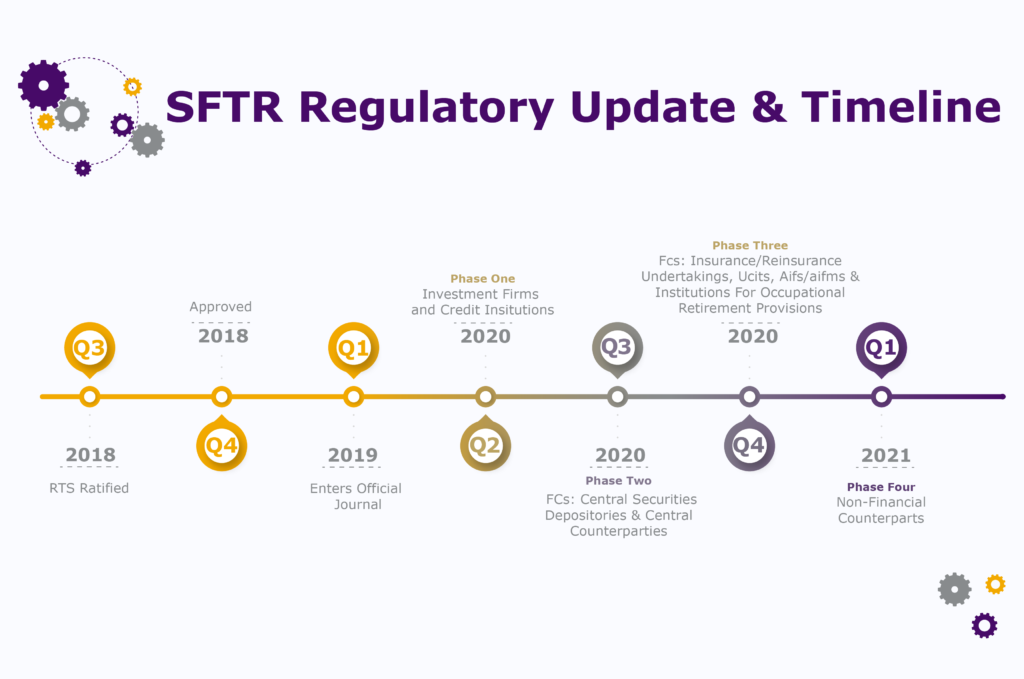

SFTR Timeline.

SFTR Timeline:

ESMA’s Role and Responsibilities in 2020

In January 2019, ESMA published its 2020 Work Programme (WP), which outlines its priorities, responsibilities, and focus areas for the next 12 months. The key issues ESMA faces in 2020 are implementing its new mandates as well as its role, which include the following:

- Direct supervision

- Supervisory convergence

- Investor protection

- Relations with third countries

- Identify areas for improved consistency of supervisory outcomes

- Ensure standardised and high-quality data

- Sustainability and technological innovation

- Build capacity to supervise Third Country Central Counterparties (CCPs)

- Promote convergence for European-based CCPs

In line with its Strategic Orientation 2016-2020, ESMA will continue to focus on its supervisory activities surrounding convergence and risk assessment in financial markets into 2020. ESMA will also support the Sustainable Finance Initiative with the ultimate goal of integrating environmental, social, and governance considerations as part of the investment chain.

One primary uncertainty for 2020 is if the UK withdraws from the European Union. However, ESMA is prepared for managing the risks of this move should a withdrawal agreement go into force.

The Impact of SFTR

SFTR has a significantly broad impact. Therefore, it is important to understand the new features and rules of the new SFTR regulations.

So, what types of firms are impacted by SFTR? In short, both financial and non-financial firms must follow SFTR requirements. This also applies to foreign and international firms.

For example, a firm that is based in and primarily operates in Europe, but that also deals with transactions to and from the United States would still be required to operate according to SFTR requirements.

Furthermore, SFTR does not negate regulations established by EMIR or MiFID/MiFIR. This means that firms must continue to abide by the transaction requirements under MiFID/MiFIR.

All in all, SFTR, EMIR, and MiFID II/MiFIR are part of a growing global effort to increase transparency and reduce risk in capital markets.

New SFTR Features

In short, the new SFTR features will include the following:

- ESMA will monitor and oversee to ensure that all trade repositories match trades.

- All firms and their branches, including third-party firms, that are located and operate within the EU are required to report details related to SFTs that are traded. They are also required to report all modifications to all trades as well as all trade terminations.

- The reporting requirements implemented by the SFTR include completing 153 reportable fields. (The standard reporting format that all institutions must follow is based on ISO 20022.)

Transaction Types

At a minimum, reports must include a variety of transaction details. These details include the following:

– The parties involved in the trade

– The type of currency involved

– The principal amount

– All collateral assets involved in the trade

– Repo rate

– Margin lending rate

– The lending fee

– The maturity date

Providing these details ensure transparency for all trades completed by entities within the EU.

As we look ahead to 2020, SFTR may require five times as many reports as trades when the regulation takes effect in early 2020.

SFTR Reporting Requirements

Below is a brief summary of the SFTR reporting requirements.

UTI / LEI. The new SFTR reporting requirements involve assigning UTIs and Legal Entity Identifiers (LEIs) to each of the counterparties involved in a trade. LEIs are 20-character, alphanumeric codes based on the International Organization for Standardization’s (ISO) ISO 17442, which enables the clear and unique identification of legal entities participating in trading activities. Assigning UTIs and LEIs is a crucial part of the SFTR effort to increase transparency and fairness for counterparties and investors.

Lifecycle Events. The new reporting requirements extend beyond reporting the details of the finalized trade. Additionally, entities and counterparties will be required to report all events, phases, details, and modifications that occur throughout the lifecycle of a trade. For example, this could include changes to market price and loan value.

Reporting Phases. ESMA recognizes that branches and firms will need adequate time to adapt to the new regulations. Therefore, in addition to the aforementioned reporting requirements, the reconciliation process for trade repositories will include two phases: reporting requirements will be introduced in phases to allow firms to accurately and efficiently manage data and to also reduce risk.

The first of these phases consists of 62 matchable fields required for the initial SFTR implementation.

The second phase will contain an additional 34 matchable fields, bringing the total number of required matchable fields to 96. This second phase is expected to begin approximately by Q2 2020.

Data and Reporting Submission (and Resubmission). The SFTR requires that all SFTs must report to a registered European trade repository by both parties within one working day of finalizing a transaction.

Validating Data and Ensuring Data Quality (Data Readiness). Due to the strict data reporting standards and the vast amount of data required reporting, firms and institutions must implement consistent and reliable procedures to help ensure the accuracy and validity of their data, or also referred to as data readiness. Accurate data validation also includes data lineage, which is the ability to trace data back to its original source.

As the total number of matchable reporting required for the first phase amounts to nearly 10 times the amount of data required to be collected under EMIR, entities subjected to these new regulations must be prepared for more intensive data collection practices.

SFTR Challenges

The implementation of SFTR has created a number of challenges for European firms and institutions. From data fragmentation to new costs related to disclosure requirements, financial and non-financial counterparties alike have been forced to adapt to these new processes to be compliant.

Here are some of the challenges associated with SFTR:

Date Reporting and Submission. This requirement presents a challenge. The reported data that must be reported is incredibly expansive and not readily available. Data such as changes to collateralization and UTI agreements between counterparties may be very difficult to obtain and report correctly.

Additionally, ESMA has proposed that relevant details must be retained for a minimum of 10 years, which is significantly longer than other regulatory requirements. As a result, these standards may cause confusion within institutions and may easily lead to the misreporting required data. As such, entities involved in these transactions must establish standard procedures to satisfy these complex reporting requirements.

Data Fragmentation. One of the primary challenges presented by the SFTR is data fragmentation and data loss. The new reporting requirements will significantly increase data volume, which also elevates the risk of organizing, storing, and collecting the necessary accurate data for reporting purposes.

Furthermore, many branches and firms will find it challenging to collect the necessary data as transaction-level data is not always available.

Data Quality. Combined with the challenge and risk of data fragmentation also elevates the risk and challenge of data quality. Firms and their branches will also be required to ensure data quality and maintenance.

As a result, entities and intermediaries will be required to gain control over data quality in order to ensure transparency and minimize risk. This means that organizations and companies will likely be required to adjust their reporting platforms and software accordingly, add in a quality assurance audit step in their processes, and perhaps recruit a third-party organization to assist in ensuring accurate data and reporting.

Costs. In addition to addressing the elevated costs that will likely be involved in minimizing risks associated with data fragmentation, accurate and quality data, and sufficient reporting, SFTR will also present new, additional costs for buyers, which are associated with being compliant with disclosure requirements. Many firms are concerned that these additional costs will influence the use of securities financing transactions as a whole.

In many cases, firms and branches will be forced to make drastic changes to their business practices and operations in order to be compliant with SFTR upon entry into force. Firms, branches, and companies that aren’t able to meet the SFTR timeline may be at risk for penalties, fees, and additional audits.

Implementation. ESMA has proposed to use ISO 20022 as the standard format for reporting SFTs in accordance with SFTR. The ISO 20022 is a standardized global approach to reporting (in terms of methodology, process, and repository) and is designed for financial standard initiatives.

ISO 20022 also has procedures in place for its maintenance and governance.

Although ESMA believes this standard will ensure transparency and allow reporting to be subjected to strict governance and regulation, adapting to the ISO 20022 procedures will be a challenge for firms.

Internal Coordination. Due to the new SFTR standards, all firms and repositories will be required to establish consistent procedures related to content handling and reporting. This is always a challenge because firms must establish and adapt to new practices, procedures, and processes. This can require significant internal coordination and resources, including time, money, and training to ensure coordination and compliance.

SFTR Solutions

Although it is clear that the new SFTR regulation creates a number of challenges for firms, branches, entities, institutions, repositories, and so on, there are also a number of basic solutions that can be utilized to mitigate challenges and risks and also successfully satisfy the new reporting requirements.

While these solutions may not cover all challenges faced by every organization, they are effective ways to help branches, firms, and other financial organizations prepare for the official and formal SFTR implementation.

Determine the Best Transaction Reporting Model. There are several different transaction reporting models and approaches that firms can leverage, ranging from in-house siloed solutions to vendor-managed solutions.

Siloed Solutions. The benefits of implementing a siloed solution are short-term cost benefits and also quick to market, allowing firms full control over maintaining ownership and control of reporting.

On the other hand, siloed solutions are driven by technology, which can pose some implementation risks that firms may not necessarily have the resources to support.

Furthermore, siloed solutions also present some scalability issues, making them a quick, short-term solution rather than a long-term solution.

Reporting Hubs. Firms can also implement an in-house reporting hub that is designed to meet regulatory requirements related to transaction and trade reporting. Again, much like siloed solutions, reporting hubs help firms maintain a level of ownership and control, improving efficiency across the firm. Reporting hubs are also typically more scalable than siloed solutions.

On the other hand, reporting hubs cannot be implemented as quickly as siloed solutions. Not only do they require more time to implement, they are also costly as they require internal subject matter experts.

Vendor-Managed Solutions. If firms are not equipped with sufficient resources to build and implement siloed solutions or reporting hubs in-house, then they may consider outsourcing reporting to a third-party vendor. Depending on the vendor, this may be a low-cost solution, however, the risks are potentially higher.

In addition to vendor quality risks, firms must also consider client data risks. There is also the dependency and reliability risk, meaning that firms must rely on an external vendor for accurate and timely reporting.

Some firms may prefer siloed solutions to vendor-managed solutions and vice versa. Firms should take the time to assess and analyze the advantages and disadvantages of each in order to identify the best possible solution.

The Use of Reporting Templates. The new SFTR reporting guidelines include a total of 153 fields, which introduces the risk of data input errors, misreporting, or missed fields.

For example, using standard reporting templates that already include the required fields is an efficient way to streamline reporting practices and mitigate the risk of misreporting data and data mishandling.

Establish a Pre-Reporting Reconciliation Process. Establishing and implementing a process that supports accurate reporting is likely one of the biggest challenges for financial and non-financial counterparties. Therefore, entities should focus their efforts on internal coordination and establishing a pre-reporting reconciliation process that ensures accurate data collection, reporting, and report submission.

For example, this particular process could include forming a data management or data readiness team that is responsible for maintaining an existing reporting platform or investing in a new platform that utilizes report templates (that are compliant with ISO 20022). Then, the data readiness team can build a process for auditing and analyzing all reports for accuracy prior to submission.

Identify Gaps Between Firms and Counterparties. In addition to the point above, firms can also work diligently with counterparties as part of the reconciliation process. This process can also help to identify insufficient or inaccurate data, recognize any discrepancies, and realize any potential gaps in reporting.

Make Informed Decisions and Identify Risks. One of the primary motivators behind the SFTR implementation is to ensure that all firms and their branches are more aware of the risks presented by all trade transactions. Therefore, this increased level of awareness will allow firms to make more informed decisions related to resource allocation, trading activities, and risk assessment, management, and response.

Conclusion

As we have witnessed thus far, SFTR has already implemented new rules, regulations, and responsibilities for financial and non-financial counterparties located and operated throughout Europe. Strict reporting guidelines, the dependence on trade repositories to match trades both within and between repositories, the range of data required to be collected, and the required assignment of UTIs and LEIs are only a few of the complex rules enacted by this regulation. We will also likely see new reporting fields and requirements through Q1 and Q2 of 2020.

From extensive data collection and potential data fragmentation to additional costs and internal coordination, the challenges created by this regulation are numerous. However, while these difficulties will take a significant amount of time, effort, training, and resources, they will help to increase trade transparency and minimize investment risks for investors.

Although the new SFTR regulation certainly presents a wealth of challenges for lenders and entities, the end goal is to reform and streamline global trading models and allow for greater transparency and a safer financial market.