Point Nine’s team of experts explain the worldwide classifications of financial instruments (CFI) and what their relationship to EMIR, MIFIR, and SFTR.

ISO 10962, (the International Organization for Standardization) Securities and related financial instruments – Classification of financial instruments (CFI code) is the worldwide reference for codes used to classify financial instruments such as cash, derivatives, or foreign exchange. It was first published in 2001 to address concerns in the financial community regarding the problems of obtaining information on securities when trading with different markets, and the inability to group securities in a consistent manner. The standard has recently been revised to address industry changes and requirements and keep it up to date with market needs.

In accordance with ISO new statement ‘The use of the codes and definitions found in the standard means increased efficiency, accuracy and transparency of financial transactions, as they can be used globally for Straight-Through Processing. It also makes the comparison of instruments that come from different countries more accurate and credible.’ However, the quality of assigned CFI to the instruments in many cases contains some inaccuracy or does not match their corresponding fields in regulatory reports.

The regulatory reporting regime like EMIR states that for all derivative types it is required to apply the ISO standard CFI code and following its 2015 update under ISO 10962, this code population is mandated under SFTR and MIFIR transaction reporting where Instrument identification code is not available for the traded instrument. The CSDR, which is aimed to improve securities settlement in the European Union, is relying on this code as well in their obligation to report. Countries outside the EEA are also using CFI code in their regulatory reporting for example in ASIC, MAS, or Dodd Frank regulations, so the widespread usage of this classification is not going to be fully replaced by implementation of UPI.

The CFI is a key element in regulatory reporting for instruments that are not listed, not standardized, and therefore potentially problematic to identify for the regulator. In this case, it is highly recommended to use appropriate CFI code by the entities obligated to report their activities to describe the instrument.

Under market surveillance legislation a Competent Authority can investigate the transaction reporting records of firms up to seven years in arrears and can impose material fines based on their findings or request to proceed with error and omission actions of back-reporting historical data. Regulators in some cases are using CFI codes to aggregate the reported transactions into desired groupings according to the instrument’s characteristics and in this way they are able to efficiently monitor exposures and risks related to distinct products or product categories.

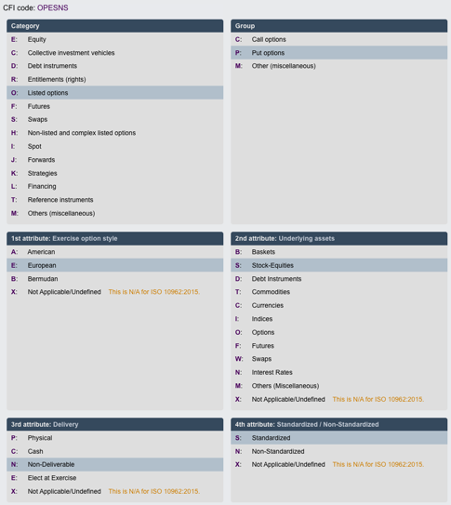

Firms should follow the best practices to apply correctly assigned CFI code to the instrument they trade and report to the regulator. Counterparties should report only valid CFIs. If the CFI does not exist in the official sources, then it should be agreed between the counterparties, as the CFI is a reconcilable Field. P9 customers have access via a web portal to CFI coder and decoder tools which allows them to independently construct or review each individual part of the code. Accessibility of the historically submitted reports and instrument data with the ability to amend or initiate remediation processes minimizing the operational cost and risk of being non compliant.

The EMIR Validation rule only applied to the first two letters of the CFI code and no validation technique is not covering the rest of the letters, however this data might be used to crosscheck other fields in the report which might be harmonized with the code underlying value. The ISDA EMIR best practice in both OTC and ETD reporting advising to use the following approach ‘If there is an ISIN for the product, populate the field with the CFI code associated with that ISIN’.

In accordance with EMIR Final report Instrument (CFI) code pertaining to the instrument. Furthermore firms would need to report ISIN and CFI for derivatives traded or admitted to trading on a trading venue, UPI – for OTC derivatives but excluding derivatives concluded on third-country venues that are similar to regulated markets (irrespective of lack of equivalence decision) and CFI only – for derivatives concluded on such third-country venues.

Association of National Numbering Agencies ANNA has encountered challenges and data quality issues with CFI code construction. These challenges around data integrity have mostly been because of jurisdictions applying CFIs on a non-consistent basis, either as a result of local regulatory rules or simply differing interpretations. In other instances, discrepancies are typically due to CFIs being generated and reported by market participants themselves, such as trading platforms, and not the official CFI designated by the NNA, where the corresponding ISIN code has been issued. This scenario would be vastly improved if all market participants used the official CFI generated by the relevant NNA when assigning the ISIN. Point Nina collects information and reconciles data provided from trading platforms against official NNAs data, data providers, ESMA and FCA FIRDS eligibility lists of instruments.

Additionally, the counterparties should classify all derivatives using the ISO 10692 CFI code (Field 9 of Table 2). Counterparties should always use official sources for the CFI. For this purpose, the CFI assigned by ANNA Derivatives Service Bureau (ANNA DSB) or the relevant National Numbering Agency (NNA) should be used. Further information can be obtained from ANNA DSB (https://www.anna-dsb.com/ufaqs/cfi-code/), from ANNA ( http://www.annaweb.org/standards/about-identification-standards/), or from the relevant NNA of the derivative.

The Point Nine validation tool applies to each individual character of CFI code ( for example, Pattern, Possible values and position or to reconcile Delivery, Option Type, Style, Asset Class / Type), and what instrument class should be reported to the appropriate regulatory regime.The validation tool capturing quality issues of the CFI value prior to submission at 5-7% rate from the reporting volume.

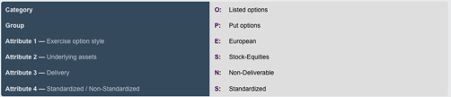

Point Nine CFI (ISO 10962:2015) Coder:

Point Nine CFI (ISO 10962:2015) Decoder: